Pain of payment, free coffee, and what it all means for cloud

What can we learn from retailers and payment providers when it comes to controlling the pain of payment?

Controlling pain of payment and why it matters for financial services and cloud

1. What do we mean by “pain of payment”?

2. Delaying the pain of payment

3. Controlling the pain of payment

4. What does this have to do with cloud?

What do we mean by “pain of payment”?

Academics have long understood that the mechanism by which you pay for something impacts your perception of its value. They called this effect “payment transparency”.

Old-school payment methods such as cash are more transparent but have more friction than a debit card because there is a greater conscious awareness that you’re exchanging something of value. Consumers spend more when payment transparency decreases and are even willing to pay more for identical products when paying with a debit card.

Why is this? Because when you’re using your debit card, “it doesn’t even feel like you’re spending real money”. The feeling of conscious awareness is known as the “pain of payment”, and modern payment methods somewhat dampen it.

You walk into Starbucks for a cappuccino. You join a queue, make your order, pay, join another queue, receive your coffee with your name scrawled on the side of the cup and then consume.

When you pay with cash, for example, the pain of payment is instant before quickly replaced by the buzz of caffeine consumption.

In our transition towards a frictionless, contactless, cashless society, there is an increasing decoupling of the moment that a consumer receives a product or service, the moment that the financial transaction is made, and the moment that the consumer feels that the purchase is made (i.e., the pain of payment).

There is an increasing decoupling of the moment that a consumer receives a product or service, the moment that the financial transaction is made, and the moment that the consumer feels that the purchase is made.

Delaying the pain of payment

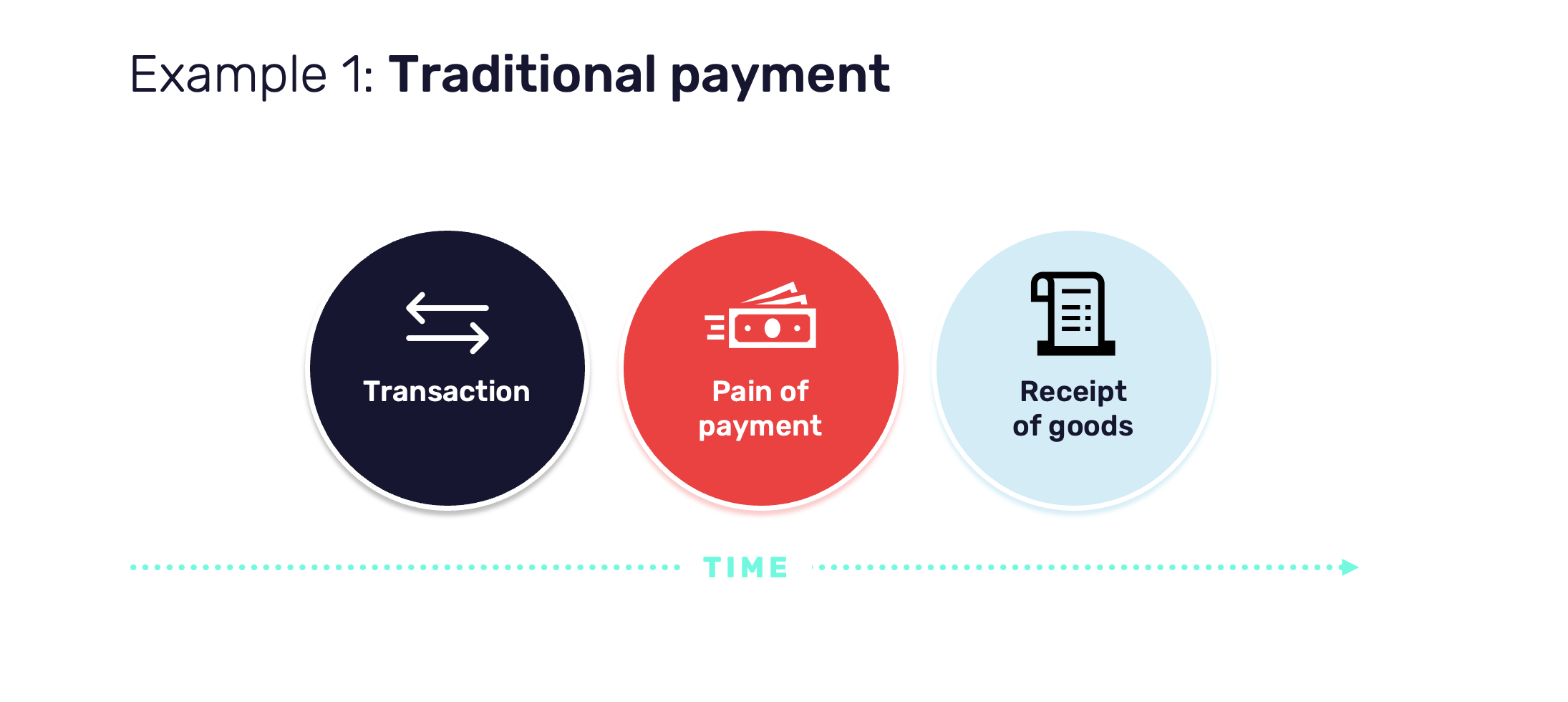

Traditionally, these moments were synchronous, they’d happen at the same time, but technology is changing that.

Buy Now Pay Later (BNPL) isn’t new. But the market has boomed recently, sparked by the pandemic-fuelled growth in online shopping and new, flexible payment options offered by alternative payment providers, like Klarna.

In the UK, NatWest, Virgin Money, HSBC and Monzo have recently launched BNPL propositions. Apple entering the BNPL space is also noteworthy. These solutions have been very successful in retail for products such as clothing, while offering business banking customers a way of smoothing out a lumpy cash flow forecast.

When ordering a product online, you make your payment at the checkout, and the money leaves your bank account instantly. The courier delivers the item to your neighbour’s house a few days later. You feel the pain of payment right there at the checkout; the reward comes much later when your neighbour kindly delivers your item to your door.

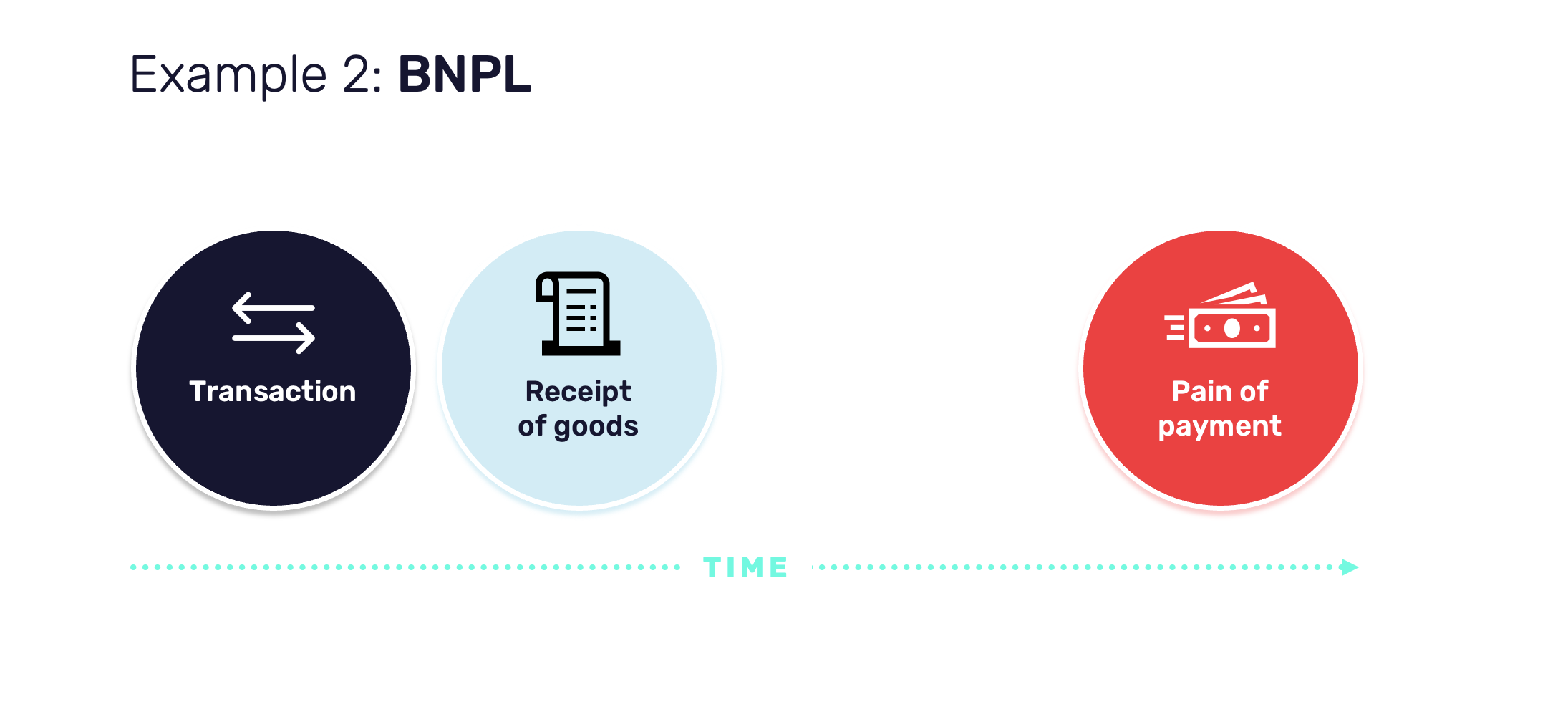

Klarna’s Pay Later solution allows you to pay for goods in full 14 or 30 days after delivery or pay later in instalments. You can order your online shopping without the pain of payment, pushing the moment down the line after the item is received.

This is smart. The pain of payment moment is becoming further detached from the moment of purchase and the moment when goods are received.

Following this transparency theory thinking, retailers who can successfully reduce the pain of payment can increase consumer spend and consumption. Back to our example of buying coffee; the pain of payment comes just as the consumer hands over the cash.

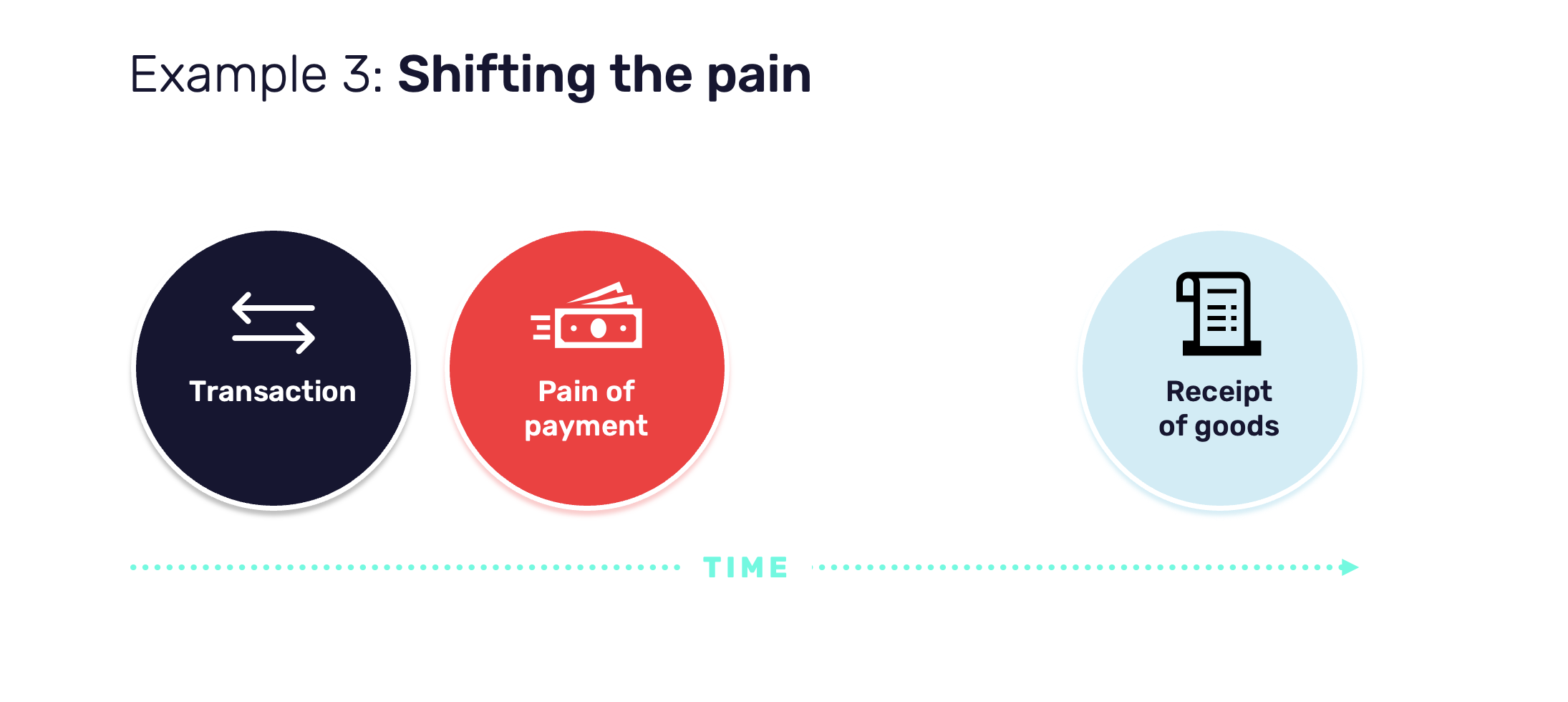

What if you could shift this moment? What if the transaction and pain of payment could happen long before the receipt of goods? If the pain of payment is history, almost forgotten, then at the point you receive something, it might even feel like a gift.

Controlling the pain of payment

But what if you shift this moment? What if the transaction and pain of payment could happen long before the receipt of goods? If the pain of payment is history, almost forgotten, then at the point you receive what you paid for, it might even feel like a gift.

What tastes better than coffee? Free coffee.

Starbucks' mobile app in the US allows users to pre-fund a digital account with a debit/credit card or Apple Pay. Customers can then use the app to place a customised order, pay ahead, and arrive at the store just as their coffee is ready.

Thirty per cent of Starbucks' transactions in the US are made via mobile. Customers save time and gain loyalty rewards in the app (like free coffee). Starbucks itself pays reduced transaction fees (since customers are paying via a gift card) and receives customer money in advance, some of which may never be redeemed - like an unused gift card. Starbucks has around $1.6 billion of customers’ preloaded cash on gift cards and the app – giving the company access to a massive interest-free line of credit.

Nowadays, most current accounts give customers instant payment notifications; the reassuring vibration of the smartphone brings the pain of payment back to the purchase moment. However, not all consumers want to delay or dampen this pain of payment moment.

The overall trend is clear: customers want more control over how and when they experience this pain of payment: beforehand (like the Starbucks app), during (with instant notifications) or afterwards (with BNPL).

What does this have to do with cloud?

Well, at Nordcloud, we think about cloud cost management similarly. And, whether it’s in our business decisions or our consumer decisions, there’s generally 3 things that drive us: saving money, saving time, and making life easier.

We know that you’re spending significant sums of money on your cloud estate, and we have offerings that give you more control. The ideas we’ve discussed around decoupling and increasing payment transparency can be neatly applied to cloud management tools, like we use and develop at Nordcloud.

A multi-cloud management tool like this brings transparency and visibility to your cloud usage and related costs. User-friendly dashboards give you real-time, consolidated information about your entire estate. Instant notifications allow you to monitor your budgets and spend proactively.

It’s an enabler to controlling that pain of payment for your cloud capacity and services. You might still be getting used to the move from fixed to variable IT costs and an approach like this gives you a unique opportunity to align activity with how finance actually works - with accurate forecasting and suggestions for cost savings. So, you can save money, save time, and make life easier for you and your stakeholders. It’s part of a cultural move towards FinOps which we see as crucial to the success of cloud.

Are you set up for digital resilience in the cloud?

For financial services, basic continuity planning has always been part of keeping up with regulations.

But two factors are driving business continuity up the agenda for FSI right now:

- The current geopolitical instability in Europe

- New regulations like DORA and NIS that require businesses to leverage digital technologies like the cloud to keep running in the event of a disruption or emergency

We have a cloud-based strategy to achieve business continuity - helping you use cloud to safeguard critical data and keep essential services running during disturbances.

It's called the Digital Vault. And our handy guide explains things a little more, and breaks down whether or not you're really resilient to potential risks. Read it here.

A guide to digital resilience in financial services

See our best practice guide to leveraging the cloud to modernise and achieve business continuity.

Get in Touch.

Let’s discuss how we can help with your cloud journey. Our experts are standing by to talk about your migration, modernisation, development and skills challenges.